http://groupanlz.blogspot.com/2009/12/trading-game-contest-update-122909.html

---------

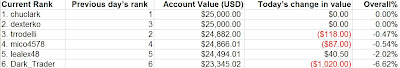

Trading Game Contest Update: 12.29.09

|

Posted by

Alexander Lê

at

1:47 AM

Jet lagged out of my mind, so might as well do some work...

Looks

like the markets are going against everyone who is actively trading.

The cash holders/non-traders are still in the lead with Dextor and

Clark leading once again.

TrrodeliSurprisingly

in third place the underdog trrodeli is holding down third place. This

is probably a reflection of his diversified portfolio over 4 equities

of INTC, BAC, GE and NKE. Having four industry distinct equities may

have helped him reduce the volatility in his portfolio.

On a

technical picture, it seems GE and BAC are against him short term.

While NKE and INTC have potential for breakout stocks (breaking of

resistence) to the upside in a short time frame (1-2 weeks). Overall

this may leave his portfolio at the same levels as they are now over

the next few weeks.

Mico4578In

fourth place Mico has a small amount of capital in NVDA. Overall, on a

technical basis NVDA has potential to garner profits, however in the

short term it is in mid correction and will be hurting Mico performance

in the interim. For the given time frame, if Mico wishes to increase

his risk he could invest more in NVDA or create some more tech oriented

plays involving peers or competitors.

lealex48In

fifth place I finally have made a right call in my position correcting

itself. 200 SMA is acting as beautiful support. I don't expect this to

be a smooth correction. It is tempting to cut my losses now as I have

recovered 50%+ of my losses at this point and reassessing new entry

points. But in the short term my system analysis is telling me price

momentum is to the upside in the short term.

I will try and watch the charts closes and avoiding another trading disaster such as my "C" <-- (click here)> trade from the last game.

Dark_TraderIt

looks like the Dark traders C position is starting to correct itself.

Just like my EUR position, entry timing was poor. Both trades could

have been vastly improved with more careful technical entry analysis.

Overall,

though short term is starting to look attractive. I see prices having

room to the upside to 3.72 before encountering resistance. Which means

Dark_Trader may recover 100% profits and may make a 7.5% profit.

Unfortunately the C position is only about 13% of the value of the

portfolio.

His major position of UNG moved further against him

from 10.68 (when I last reported) to 10.85 on a short position.

However, short term the picture is slowly starting to correct, though I

still believe a bit of room to the upside (via RSI). All in all, it is

possible he can recover 90% of his trade to the low 10's when UNG

corrects, the big question is if he believes prices can break below 50

day SMA. If not perhaps this is a bottom for nat gas? (watch the higher

highs). If prices break below support perhaps he can end up in profit

though the odds are against him on the technical side or are at least

more to the ambiguous side.

So there are your update brief trading technical tips:

"May the trade be with you"-----

Alexander Lê

Analyze Capital LLC

Managing Partner

email: le.alex48@gmail.com

-----

****note from management****

The managing partners are currently abroad extending networks across the UK and Eastern Europe.

We

apologize ahead of time for the slow responses to blog comments and

lack of posts. Though come mid January we will resume the normal

schedule and updates.

-----

If there are any urgent matters forward emails to one of the partners:

Analyze Capital LLC

Managing Partners

Alexander Lê: le.alex48@gmail.com

Pat Ambrus: ambrus.anlzgroup@gmail.com

Clark Chu: zhuzihao@googlemail.com