|

| | Equity Trading |  |

| | | Author | Message |

|---|

Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Equity Trading Subject: Equity Trading  Mon Oct 26, 2009 3:37 pm Mon Oct 26, 2009 3:37 pm | |

| All post here about Equity Trading | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Check out the rising star trader MIke Liu Subject: Check out the rising star trader MIke Liu  Mon Oct 26, 2009 3:56 pm Mon Oct 26, 2009 3:56 pm | |

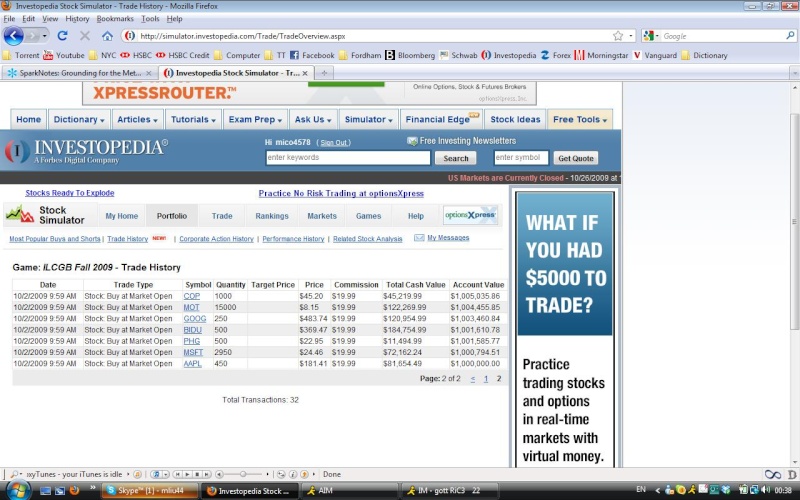

| This is the first time Mike has been paper trading. For about a 1 month period his portfolio is up over 10% and he has little to no exposure to financial markets prior to his trading game. He trades naturally and is slowly learning how to develop his own style and discipline. Watch out for this kid, hes got mass potential... [img][/img]  - Code:

-

| |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Wed Oct 28, 2009 6:45 pm Wed Oct 28, 2009 6:45 pm | |

| Nice work Mike. I am happy to see he is having early success. | |

|   | | Sauros

Posts : 516

Join date : 2009-05-14

Age : 50

Location : London

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Thu Oct 29, 2009 10:41 pm Thu Oct 29, 2009 10:41 pm | |

| | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Thu Oct 29, 2009 11:50 pm Thu Oct 29, 2009 11:50 pm | |

| Mike is a rising star who is learning how hard the markets can be when you don't manage risk properly lol - he comes to our weekly meetings, he is quite a youngin but a very smart fellow at our school | |

|   | | Sauros

Posts : 516

Join date : 2009-05-14

Age : 50

Location : London

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Fri Oct 30, 2009 8:31 pm Fri Oct 30, 2009 8:31 pm | |

| - Snapman wrote:

- Mike is a rising star who is learning how hard the markets can be when you don't manage risk properly lol - he comes to our weekly meetings, he is quite a youngin but a very smart fellow at our school

It's good to know that some young people are still interested in trading : "trader" sounds like an insult in France... Welcome Mike in our world, the road is still long... Discipline, skill and courage and you'll become a lord of trading (probably way before me...) | |

|   | | mico4578

Posts : 1

Join date : 2009-10-21

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Wed Nov 04, 2009 4:51 pm Wed Nov 04, 2009 4:51 pm | |

| | |

|   | | Scalpuman

Admin

Posts : 1174

Join date : 2009-05-13

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Thu Nov 05, 2009 10:49 am Thu Nov 05, 2009 10:49 am | |

| Hi Mike, you may be interested to know that for stock pickers using a practice account like you, some sites including updown give you money when you beat the S&P on a monthly basis : follow the link here : http://www.lordoftrading.com/TheSitesYouNeed.html#Practice We've not tried updown yet but would be great if you could test there an account (and make money  ) and give us your feedback for "the Lord of Trading / Analyse Capital" to think about organizing a trading contest. Thanks | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Thu Nov 05, 2009 4:57 pm Thu Nov 05, 2009 4:57 pm | |

| - Scalpuman wrote:

- Hi Mike, you may be interested to know that for stock pickers using a practice account like you, some sites including updown give you money when you beat the S&P on a monthly basis : follow the link here : http://www.lordoftrading.com/TheSitesYouNeed.html#Practice

We've not tried updown yet but would be great if you could test there an account (and make money  ) and give us your feedback for "the Lord of Trading / Analyse Capital" to think about organizing a trading contest. ) and give us your feedback for "the Lord of Trading / Analyse Capital" to think about organizing a trading contest.

Thanks Sounds like a great idea for a trading contest. You wouldn't be happen to be getting paid be etaruo now would you?  hahaha | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Thu Nov 05, 2009 4:57 pm Thu Nov 05, 2009 4:57 pm | |

| http://groupanlz.blogspot.com/2009/11/spx-morning-update-110509.html

Here are my updates on my trades on C and SGP and the the SPX (exposure via the SSO) | |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Thu Dec 03, 2009 5:35 pm Thu Dec 03, 2009 5:35 pm | |

| Via Oiltradersblog.blogspot.com: Market Leaders beggining to Fade?

Apple (AAPL) and Goldman Sachs (GS) stocks have been the most prominent

market leaders of this stock market rally. They are both losing

momentum. Is this a warning signal? Is the green light for the bears to

plunge on the short side?

"A

couple of weeks ago, we noted that Goldman Sachs had been

uncharacteristically underperforming the market. Throughout the rally,

both Goldman and Apple had been market leaders, but Goldman was

curiously left behind as the S&P 500 hit new highs in November. Now

it looks like Apple is beginning to do the same. Since peaking in

mid-November, Apple has been struggling, and it is getting close to

breaking below its 50-day moving average just as the overall market

attempts to make new highs once again. The S&P 500 is on a 3-day

winning streak, but Apple (AAPL) is on a 6-day losing streak." In BIG website

Oil

Trader`s Blog is a trading community for active online futures and

stock traders. We provide our real time trading decisions and our

market analysis on this website.

=============================================================================================

What does this mean to the S&P 500 overall? Time will tell.

Snapman suggested yesterday that the S&P might have a higher

resistence level then the psychological 1100. Good Call. Where will

we see Support?

| |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Thu Dec 03, 2009 5:38 pm Thu Dec 03, 2009 5:38 pm | |

| Barclays Said to Plan Salary Increases, Lower Bonuses (Update1)

By Gavin Finch

Dec. 3 (Bloomberg) -- Barclays Plc, Britain’s second- biggest lender, plans to raise investment bankers’ base salaries as a percentage of total pay, according to a person familiar with the matter.

The change will mainly affect junior and mid-level employees, said the person, who declined to be identified because the talks are private. Barclays Capital, the London- based bank’s securities unit, employs about 20,000 people.

Governments around the globe have sought to rein in pay after banker bonuses were blamed for increasing risks that led to the financial crisis. Barclays, which didn’t receive a government bailout, is raising salaries after Edinburgh-based Royal Bank of Scotland Group Plc said it granted the Treasury control over its 2009 bonus pool in return for receiving a 45.5 billion-pound ($76 billion) rescue.

Leaders of the Group of 20 nations agreed in September to adopt compensation guidelines for banks that discourage bonus guarantees extending more than one year, encourage companies to defer bonuses for senior executives and other key employees, and permit pay to be clawed back if losses occur later. The changes Barclays is making to compensation are designed to comply with the G-20 principles, the person familiar said.

“This is a growing trend among banks that will likely be adopted by more,” said Shaun Springer, chief executive officer of Square Mile Services Ltd., which advises London financial firms on pay. “G-20 should have been aware of this trend as it predated their meeting. One assumes that they expected this to happen and are comfortable with it.”

Credit Suisse Group AG, Switzerland’s second-biggest bank, said in October it would raise salaries as a percentage of total pay for about 7,000 managing directors and directors from Jan. 1.

A Barclays spokesman declined to comment. The bank will backdate the pay rise to June to give employees cash as their bonuses will be paid mostly in deferred stock, the Daily Telegraph reported earlier today, without saying where it got the information.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------

This seems to be the case all over the world of Investment Banking. Especially for the Managing Directors and up. Maybe some of our good friends could elaborate on this trend. | |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Wed Feb 03, 2010 7:34 pm Wed Feb 03, 2010 7:34 pm | |

| I am not clear on El-Erian's time frame, but I do value his insights. He has made many correct calls throughout the great recession. How much of that is insider information? Probably alot considering PIMCO can manipulate bond prices when they see fit. Just food for thought.

========================================

El-Erian Says Retreat in Stocks Will Worsen as Economy Slumps

Feb. 3 (Bloomberg) -- Mohamed A. El-Erian, whose firm runs

the world’s biggest mutual fund, said the largest stock market

decline in 11 months may worsen amid persistent U.S. joblessness

and economic growth that trails analysts’ forecasts.

Investors have wrongly priced in an “orderly” withdrawal of

stimulus measures, a rebound in bank lending and coordinated

government policy to restore growth, the chief executive officer

of Pacific Investment Management Co. wrote in a Bloomberg News

column. That means Wall Street projections for gains in 2010 may

prove incorrect and prices will slump, he said.

“Investors may well find that January’s global equity

sell-off was just a precursor to a disappointing year for

several asset classes,” El-Erian, 51, wrote. “The global

financial crisis has undermined growth and job creation; it has

clogged many of the pipes that allocate funds to productive

uses; and it has rapidly taken public debt and the budget

deficit to worrisome levels.”

The Standard & Poor’s 500 Index fell 3.7 percent in

January, more than any month since February 2009, after China

set higher reserves for lenders and U.S. President Barack Obama

proposed curbs on risk taking at banks. The retreat pared the

S&P 500’s gain since sinking to a 12-year low in March to 59

percent. The MSCI Emerging Markets Index lost 5.7 percent last

month, also the biggest decrease since February.

‘Sugar High’

The benchmark index for U.S. equities traded for more than

24 times annual income at the end of 2009, the most since 2002,

according to data compiled by Bloomberg. The ratio slipped to

19 times profits as 77 percent of S&P 500 companies earned more

in the fourth quarter than analysts predicted.

“Judging from market valuations, I sense quite a gap

between consensus market expectations and key political and

economic realities, especially in the U.S.,” he wrote.

El-Erian, whose firm manages $1 trillion from Newport

Beach, California, said in a July 29 interview on CNBC that the

rally in U.S. equities was a “sugar high” that wouldn’t be

sustained by economic growth. The S&P 500 has climbed 13 percent

since then. On Oct. 10, 2008, he said the “point of exhaustion”

for the credit crisis was “far away.” The S&P 500 decreased 25

percent through March 9, falling in four of five months.

The 13 Wall Street strategists tracked by Bloomberg News

project that the S&P 500 will rise 10 percent in 2010, according

to the average estimate. The average year-end forecast of 1,232

represents an advance of 12 percent from yesterday’s close of

1,103.32.

New Normal

Pimco’s Bill Gross and El-Erian say investors should expect

returns that trail the historical average because of more

government regulation, lower consumption and a smaller role for

the U.S. in the global economy. American gross domestic product

may expand 2.7 percent in 2010 and 2.9 percent in 2011 as demand

recovers from the first global recession since World War II,

based on the median economist forecast from a Bloomberg survey.

U.S. equities returned 6 percent a year on average since

1900, according to inflation-adjusted data compiled by the

London Business School and Zurich-based Credit Suisse Group AG

in a February 2009 report.

The U.S. government’s budget deficit in the fiscal year

that ended Sept. 30 was a record $1.42 trillion. El-Erian wrote

that too many market participants assume the U.S. will pass

“pro-growth medium-term fiscal adjustment programs” and that the

integrity of public institutions will be maintained.

“A more realistic assessment of these factors would caution

against an excessive focus on changes in growth rates at a time

when absolute levels are horribly out of whack,” he wrote. “The

longer this is delayed, the greater the scope for policy mishaps

and market disappointments.” | |

|   | | Sauros

Posts : 516

Join date : 2009-05-14

Age : 50

Location : London

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Thu Feb 04, 2010 12:08 am Thu Feb 04, 2010 12:08 am | |

| - Batman wrote:

- I am not clear on El-Erian's time frame, but I do value his insights. He has made many correct calls throughout the great recession. How much of that is insider information? Probably alot considering PIMCO can manipulate bond prices when they see fit. Just food for thought.

Regarding PIMCO have a look in the crypt, quite interesting report from Gross. | |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Mon Feb 08, 2010 5:43 pm Mon Feb 08, 2010 5:43 pm | |

| Sixteen banks have failed so far this year. 1st American State Bank of Minnesota of Hancock, Minnesota was the latest bank to be shut down on Friday. In the past few years investing in bank stocks have gotten tricky as many of them have been battered by the credit crisis. However there are some high quality banks which continue to remain strong and pay dividends. The Forbes magazine published a list of America’s best and worst 100 banks last month. These banks were ranked on the following factors:

- Return on average equity

- Net interest margin

- NPLs as a percentage of loans

- NPAs as percentage of assets

- Reserves as a percentage of NPLs

- Two capital ratios (Tier 1 and risk-based)

- Leverage ratio

The size of the banks selected ranged with assets of $5.2B to $2.3T. Investors can use the Forbes list as a starting point to identify potential candidates for investment opportunities. The Five Best Banks are: Bank of Hawaii (BOH) Current Dividend Yield: 4.13% UMB Financial (UMBF) Current Dividend Yield: 1.97% Commerce Bancshares (CBSH) Current Dividend Yield: 2.45% Prosperity Bancshares (PRSP) Current Dividend Yield: 1.59% SVB Financial (SIVB) Current Dividend Yield: N/A The Five Worst Banks are: Capitol Bancorp (CBC) Sterling Financial (STSA) R & G Financial W Holding (WHI) Flagstar Bancorp (FBC) The highest ranked bank in this list was Bank of Hawaii (BOH). This conservative bank had a non-performing loan ratio of just 1.2% of total loans in the last quarter. Bank of Hawaii also declined TARP funds from the Federal government. Many of the banks that declined TARP funding actually increased lending. Another bank that is noted in the article is Capital Bancorp (CBC) of Michigan. The bank has a presence in 17 states, but has been badly hurt by the severe economic problems of its home state. Its capital ratios of 8.4% (Tier 1) and 11.2% (risk-based) are both sixth worst among the 100 largest banks. The bank is divesting businesses in six states, including problem areas like California and Ohio to boost its capital ratios and improve its balance sheet. | |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Mon Feb 08, 2010 8:24 pm Mon Feb 08, 2010 8:24 pm | |

| Shares of CIT Group (CIT) initially jumped on the news that John Thain will take over as its new chairman and CEO, but not everyone is buying into the surge.

CIT was up by 3.74 percent on the day, trading at $31.90. It had been trending lower after hitting a high of $36 on January 12.

Within a span of 25 minutes this morning we see two blocks of 2,000 July 32 calls and one block of 4,000 sold for $4.85 against open interest of just 23 contracts. We also see a block of 2,000 July 35 calls sold for $3.65 against open interest of 118 contracts.

This high premium reflects the relatively high implied volatility in these options. The average implied volatility sits at 59 percent, whilethe 30-day historical volatility is 35 percent. All of this call selling is likely done against long stock in a covered call position, which would protect against the unlimited loss potential of just being short the calls. | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Tue Feb 09, 2010 3:07 am Tue Feb 09, 2010 3:07 am | |

| - Batman wrote:

- Shares of CIT Group (CIT) initially jumped on the news that John Thain will take over as its new chairman and CEO, but not everyone is buying into the surge.

CIT was up by 3.74 percent on the day, trading at $31.90. It had been trending lower after hitting a high of $36 on January 12.

Within a span of 25 minutes this morning we see two blocks of 2,000 July 32 calls and one block of 4,000 sold for $4.85 against open interest of just 23 contracts. We also see a block of 2,000 July 35 calls sold for $3.65 against open interest of 118 contracts.

This high premium reflects the relatively high implied volatility in these options. The average implied volatility sits at 59 percent, whilethe 30-day historical volatility is 35 percent. All of this call selling is likely done against long stock in a covered call position, which would protect against the unlimited loss potential of just being short the calls. If you were trading CIT would be long or short? | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: MRK trade Subject: MRK trade  Mon Apr 12, 2010 7:58 pm Mon Apr 12, 2010 7:58 pm | |

| I've been trading MRK for some time now, heathcare reform of course had no affect on it, as we all know healthcare heads signed off with obama along time ago.. I think in the short term this stock is dead. I'm thinking about dumping it.. anyone else wanna give their two cents on MRK? | |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Tue Apr 13, 2010 6:51 pm Tue Apr 13, 2010 6:51 pm | |

| - Snapman wrote:

- I've been trading MRK for some time now, heathcare reform of course had no affect on it, as we all know healthcare heads signed off with obama along time ago.. I think in the short term this stock is dead. I'm thinking about dumping it.. anyone else wanna give their two cents on MRK?

Just doing some brief Sentimental Analysis, analyst outlooks for growth compared to the industry averages do not look promising in the short(qoq) or long-term(5 years). Additionally, a few analysts have downgraded their q1 EPS estimate. The biggest problem with analyst estimates is they are all about short-term performance. Long-term equity holders have little use for these. IMO, I think much of the firm's future success will depend on how well they implement SGP product and development groups & R&D (pipeline) teams into Merck. If this Merger was purely a reaction to Pfizer Wyeth, Roch Genentech, Eli ImClone, then as a shareholder you may want to get out while you can...However, If one believes the Merger will slash costs as forecasted and help Merck take some market share away from Pfizer as their drugs (Lipitor and Viagra) come off patent in 2011 and 2013 respectively, then one could be justified in long-term bullishness. Undoubtedly, if one believes value was actually created through the merger, then $36/share may be viewed as a discount. Though, if I were to play Pharma, I would buy convertible preferred notes. Lock in the anual dividend and retain the right to purchase equity at a later date if that new pipeline bears any fruit. | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Tue Apr 13, 2010 8:30 pm Tue Apr 13, 2010 8:30 pm | |

| - Batman wrote:

- Snapman wrote:

- I've been trading MRK for some time now, heathcare reform of course had no affect on it, as we all know healthcare heads signed off with obama along time ago.. I think in the short term this stock is dead. I'm thinking about dumping it.. anyone else wanna give their two cents on MRK?

Just doing some brief Sentimental Analysis, analyst outlooks for growth compared to the industry averages do not look promising in the short(qoq) or long-term(5 years). Additionally, a few analysts have downgraded their q1 EPS estimate. The biggest problem with analyst estimates is they are all about short-term performance. Long-term equity holders have little use for these.

IMO, I think much of the firm's future success will depend on how well they implement SGP product and development groups & R&D (pipeline) teams into Merck. If this Merger was purely a reaction to Pfizer Wyeth, Roch Genentech, Eli ImClone, then as a shareholder you may want to get out while you can...However, If one believes the Merger will slash costs as forecasted and help Merck take some market share away from Pfizer as their drugs (Lipitor and Viagra) come off patent in 2011 and 2013 respectively, then one could be justified in long-term bullishness.

Undoubtedly, if one believes value was actually created through the merger, then $36/share may be viewed as a discount. Though, if I were to play Pharma, I would buy convertible preferred notes. Lock in the anual dividend and retain the right to purchase equity at a later date if that new pipeline bears any fruit. Long term im bullish no doubt on the company, i have no doubt about the value added form the merger and the good R&D that merck can turn out. Its been awhile since they got a billion dollar drug though. Short term, though Im just worried about the opportunity cost, something else maybe attractive its stale in the short run. | |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Tue Apr 13, 2010 8:36 pm Tue Apr 13, 2010 8:36 pm | |

| - Snapman wrote:

- Batman wrote:

- Snapman wrote:

- I've been trading MRK for some time now, heathcare reform of course had no affect on it, as we all know healthcare heads signed off with obama along time ago.. I think in the short term this stock is dead. I'm thinking about dumping it.. anyone else wanna give their two cents on MRK?

Just doing some brief Sentimental Analysis, analyst outlooks for growth compared to the industry averages do not look promising in the short(qoq) or long-term(5 years). Additionally, a few analysts have downgraded their q1 EPS estimate. The biggest problem with analyst estimates is they are all about short-term performance. Long-term equity holders have little use for these.

IMO, I think much of the firm's future success will depend on how well they implement SGP product and development groups & R&D (pipeline) teams into Merck. If this Merger was purely a reaction to Pfizer Wyeth, Roch Genentech, Eli ImClone, then as a shareholder you may want to get out while you can...However, If one believes the Merger will slash costs as forecasted and help Merck take some market share away from Pfizer as their drugs (Lipitor and Viagra) come off patent in 2011 and 2013 respectively, then one could be justified in long-term bullishness.

Undoubtedly, if one believes value was actually created through the merger, then $36/share may be viewed as a discount. Though, if I were to play Pharma, I would buy convertible preferred notes. Lock in the anual dividend and retain the right to purchase equity at a later date if that new pipeline bears any fruit.

Long term im bullish no doubt on the company, i have no doubt about the value added form the merger and the good R&D that merck can turn out. Its been awhile since they got a billion dollar drug though. Short term, though Im just worried about the opportunity cost, something else maybe attractive its stale in the short run. Opportunity cost, Well put Snapman. | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Mon Apr 26, 2010 9:27 pm Mon Apr 26, 2010 9:27 pm | |

| im currently equity paper short on the SPY.... anyone else think these SPX levels require a pull back? Lots of flight to Quality to US this is gonna wind down, and hopefully soon, markets certainly are being more irrational than ill be liquid.

Though either way im still sure 2010 will be bullish for the SPX... i once heard there was a concensus that levels will end up around 1100 by the end of Q4

anyone else think this could be higher? 1300's 1400's ??/

anyone else trading equities in this dicey environment? | |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Sun May 23, 2010 2:36 pm Sun May 23, 2010 2:36 pm | |

| Via FT Alphaville:

The shorts are innocent and bonds are not safe havens

Posted by Izabella Kaminska on May 21 18:02.

Len Welter, Chief Technology Officer, at Data Explorers — which monitors short positions — is not convinced short positions had anything to do with driving the current equity sell-off.

According to him, analysis of institutional flows indicates that there were six times as many longs as shorts in the market throughout most of last year, as well as leading up to May.

As he stated in a note on Friday (our emphasis):

While our DX Long-Short Ratio is off from its year-end high, we have seen an increase of 2% from the low on 7 May, despite the turmoil this week. We have also noticed that since July, institutional funds have not sought the traditional safety of fixed income.

Data Explorers, meanwhile, added the following context:

Short selling does not seem to have played a major part in recent downturn.

- The DX Long-Short Ratio (Global) is down 11% from the 52 week high of 31 Dec 2009, but up 2% from the 52 week low of 7 May 2010.

- The DX Long-Short Ratio (Global Equities) is down 15% from the 52 week high of 5 Jan 2010 but still above the low of 21 May 2009.

- To put this in context, the S&P 500 is down 3.9% and the STOXX 600 is down 6.4% since the start of the 2010

And here are the charts:

Investors, it turns out, may also be sticking firm with equities — rather than turning to safe haven investments in fixed income markets.

For example, according to Data Explorers, the global fixed income/equity long ratio has maintained a bias towards equities since last July.

A trend which started last July – this could signal that bonds are not considered a ‘safe haven’ from the turmoil in the equity market.

We guess that almost poses the question if equities are really the new safe haven.

After all, it is a sovereign debt crisis — right? | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Sun May 23, 2010 7:25 pm Sun May 23, 2010 7:25 pm | |

| - Batman wrote:

- Via FT Alphaville:

The shorts are innocent and bonds are not safe havens

Posted by Izabella Kaminska on May 21 18:02.

Len Welter, Chief Technology Officer, at Data Explorers — which monitors short positions — is not convinced short positions had anything to do with driving the current equity sell-off.

According to him, analysis of institutional flows indicates that there were six times as many longs as shorts in the market throughout most of last year, as well as leading up to May.

As he stated in a note on Friday (our emphasis):

While our DX Long-Short Ratio is off from its year-end high, we have seen an increase of 2% from the low on 7 May, despite the turmoil this week. We have also noticed that since July, institutional funds have not sought the traditional safety of fixed income.

Data Explorers, meanwhile, added the following context:

Short selling does not seem to have played a major part in recent downturn.

- The DX Long-Short Ratio (Global) is down 11% from the 52 week high of 31 Dec 2009, but up 2% from the 52 week low of 7 May 2010.

- The DX Long-Short Ratio (Global Equities) is down 15% from the 52 week high of 5 Jan 2010 but still above the low of 21 May 2009.

- To put this in context, the S&P 500 is down 3.9% and the STOXX 600 is down 6.4% since the start of the 2010

And here are the charts:

Investors, it turns out, may also be sticking firm with equities — rather than turning to safe haven investments in fixed income markets.

For example, according to Data Explorers, the global fixed income/equity long ratio has maintained a bias towards equities since last July.

A trend which started last July – this could signal that bonds are not considered a ‘safe haven’ from the turmoil in the equity market.

We guess that almost poses the question if equities are really the new safe haven.

After all, it is a sovereign debt crisis — right? lets keep this thread for people's actual trading position or stratgies one wishes to employ for trading equities, if you want I can create a separate thread for equity related news | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Thu Jun 24, 2010 5:47 pm Thu Jun 24, 2010 5:47 pm | |

| Interesting approach to stock picking:

http://www.zerohedge.com/article/look-how-i-am-picking-stocks-short-balance-year?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29&utm_content=Google+Reader

"CLICK ON LINK TO SEE CHARTS"

A Look Into How I Am Picking Stocks to Short For the Balance of the Year

Submitted by Reggie Middleton on 06/24/2010 09:57 -0500

For those who are new to my writings and research (those who follow me should skip down to the next section), I have had relatively strong results in ferreting out weak companies which the sell side, the ratings agencies and the media consider “buys”, “conviction buys”, and AAA/AA credits – only to collapse, be acquired on the cheap or fall into bankruptcy less than a year later. Despite the painful rides necessary to ride out volatile markets that absolutely ignore fundamentals, in the end broke is broke and insolvent businesses tend not to last very long. The list of companies called out as insolvent against the rating agencies/sell side analysts/super smart billionaire investment crowd include:

Bear Stearns: Is this the Breaking of the Bear? and Lehman Brothers (Is Lehman really a lemming in disguise)

Washington Mutual and Countrywide

Hovnanian: Credibility is the Key to Success for a CEO � Hovnanian has Lost that Key: A letter to Mr. Hovnanian

General Growth Properties: “GGP and the type of investigative analysis you will not get from your brokerage house“ (BoomBustBlog professional subscribers can download the entire GGP composite history in .pdf format)

MBIA and Ambac: A Super Scary Halloween Tale of 104 Basis Points Pt I & II, by Reggie Middleton

among approximately 50 other similar calls..

These calls provided 5 quarters in a row of phenomenal returns (see performance) until the massive market melt-up of 2009 where we saw fundamentals get thrown down the sewer drain while math and common sense were turned on their respective heads. Well, guess what boys and girls… Methinks math is back and it may be here to stay for a while.

The Latest BoomBustBlog Research

Continuing our Bankruptcy Search Series (see BoomBustBlog Bankruptcy Search: Focus on British Petroleum and Collateral Damage and The BoomBustBlog Pan-European Sovereign Debt Crisis Bankruptcy Search) I am moving on to the broad, non-financial sector in the US. Please keep in mind that this is a list for bearish investors who wish to take short positions, and thus does not aim to find the absolute weakest companies but strives to find the companies whose share prices will drop the farthest on a risk weighted basis. The share float, share price, market cap, (over)valuation, cash flows, revenue growth, interest coverage, net debt, etc. can (on a cumulative basis) trump outright insolvency – particularly if the market has already priced such in. In essence, we aim to find the next unpublicized financial collapse that can be primarily captured with short equity positions and options, although CDS investors can definitely benefit from the list as well.

After completing the first round of shortlisting in the non-financial sector, we shortlisted 7 companies using the following process:

Step 1: Retrieved data for a list of 1,415 companies with a market cap of more than $200 million and share price of more than $15

Step 2 – Excluded 516 companies with negative net debt, due to the relative strength of their balance sheets

Step 3 – Excluded 211 companies with positive average sales growth in 2009-2011 as well as positive sales growth in last FY and FQ due to improving fundamental conditions. We added back in 17 companies with interest coverage less than our required benchmark, assuming that those improving conditions failed to stem the debt service bleeding.

Step 4- Excluded 41 companies with small floats

Step 5 – Selected 161 companies which either had interest coverage less than our benchmark in 2009 or have net debt to market cap of more than 1.0x (insolvency based on market pricing).

Step 6: Of the selected 161 companies, the 31 companies with the weakest interest coverage were then shortlisted. These 31 companies were analyzed individually by hand based on various financial, operational metrics, and 9 companies were selected for trend analysis. At this point, database scans become inaccurate and you need a seasoned, educated eye to peruse the footnotes of the filings and releases to catch the BSFP (BS in the fine print).

Step 7: Based on a trend analysis and the debt maturity schedules of these 9 companies, two companies – DIN US Equity and OTT US Equity were excluded owing to relatively stable earnings stream, no major debt maturities in the near-term and the debt largely carrying fixed rates of interest

Step 8: We have analyzed 6 companies out of the final shortlisted 8 comps and following are the key findings of these companies. Two comps are airline companies and their earnings stream is largely influenced by oil prices. Since the dynamics of this highly leveraged sector is different from most normal manufacturing businesses, we are looking deeper into these companies to come up with some empirical conclusions (this study has been completed and will be released as a follow-up analysis).

This is a snapshot of the initial 1,415 company initial scan along with solvency metrics for each company.

This is presented as a live, embedded spreadsheet and is available, free to all by clicking here (feel free to register as well, its free – register then choose the free subscription option). I urge all who may be bearish this summer to peruse the spreadsheet for it contains the pricing and major solvency metrics for over 1400 companies whose shares have skyrocketed over the past year. As some may realize, literally insolvent companies’ shares have participated in that skyrocketing!

The following link reveals the key details behind the weak points of the six shortlisted and analyzed companies (for subscribers only): Non-Financial Retail Subscriber Short List

Pro and institutional subscribers can access an expanded list of 33 companies here.

For those of you who have not registered or subscribed, there is still a company of interest that I will share in case you feel Europe will blow up and the US will hit a double dip recession. This is not nearly a strong a candidate as any of the subscription analyzed companies, but it is worth discussion.

5

Your rating: None Average: 5 (1 vote)[b] | |

|   | | Batman

Posts : 786

Join date : 2009-08-06

Age : 36

Location : NYC

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Fri Jun 25, 2010 4:33 pm Fri Jun 25, 2010 4:33 pm | |

| - Snapman wrote:

- Interesting approach to stock picking:

http://www.zerohedge.com/article/look-how-i-am-picking-stocks-short-balance-year?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29&utm_content=Google+Reader

"CLICK ON LINK TO SEE CHARTS"

A Look Into How I Am Picking Stocks to Short For the Balance of the Year

Submitted by Reggie Middleton on 06/24/2010 09:57 -0500

For those who are new to my writings and research (those who follow me should skip down to the next section), I have had relatively strong results in ferreting out weak companies which the sell side, the ratings agencies and the media consider “buys”, “conviction buys”, and AAA/AA credits – only to collapse, be acquired on the cheap or fall into bankruptcy less than a year later. Despite the painful rides necessary to ride out volatile markets that absolutely ignore fundamentals, in the end broke is broke and insolvent businesses tend not to last very long. The list of companies called out as insolvent against the rating agencies/sell side analysts/super smart billionaire investment crowd include:

Bear Stearns: Is this the Breaking of the Bear? and Lehman Brothers (Is Lehman really a lemming in disguise)

Washington Mutual and Countrywide

Hovnanian: Credibility is the Key to Success for a CEO � Hovnanian has Lost that Key: A letter to Mr. Hovnanian

General Growth Properties: “GGP and the type of investigative analysis you will not get from your brokerage house“ (BoomBustBlog professional subscribers can download the entire GGP composite history in .pdf format)

MBIA and Ambac: A Super Scary Halloween Tale of 104 Basis Points Pt I & II, by Reggie Middleton

among approximately 50 other similar calls..

These calls provided 5 quarters in a row of phenomenal returns (see performance) until the massive market melt-up of 2009 where we saw fundamentals get thrown down the sewer drain while math and common sense were turned on their respective heads. Well, guess what boys and girls… Methinks math is back and it may be here to stay for a while.

The Latest BoomBustBlog Research

Continuing our Bankruptcy Search Series (see BoomBustBlog Bankruptcy Search: Focus on British Petroleum and Collateral Damage and The BoomBustBlog Pan-European Sovereign Debt Crisis Bankruptcy Search) I am moving on to the broad, non-financial sector in the US. Please keep in mind that this is a list for bearish investors who wish to take short positions, and thus does not aim to find the absolute weakest companies but strives to find the companies whose share prices will drop the farthest on a risk weighted basis. The share float, share price, market cap, (over)valuation, cash flows, revenue growth, interest coverage, net debt, etc. can (on a cumulative basis) trump outright insolvency – particularly if the market has already priced such in. In essence, we aim to find the next unpublicized financial collapse that can be primarily captured with short equity positions and options, although CDS investors can definitely benefit from the list as well.

After completing the first round of shortlisting in the non-financial sector, we shortlisted 7 companies using the following process:

Step 1: Retrieved data for a list of 1,415 companies with a market cap of more than $200 million and share price of more than $15

Step 2 – Excluded 516 companies with negative net debt, due to the relative strength of their balance sheets

Step 3 – Excluded 211 companies with positive average sales growth in 2009-2011 as well as positive sales growth in last FY and FQ due to improving fundamental conditions. We added back in 17 companies with interest coverage less than our required benchmark, assuming that those improving conditions failed to stem the debt service bleeding.

Step 4- Excluded 41 companies with small floats

Step 5 – Selected 161 companies which either had interest coverage less than our benchmark in 2009 or have net debt to market cap of more than 1.0x (insolvency based on market pricing).

Step 6: Of the selected 161 companies, the 31 companies with the weakest interest coverage were then shortlisted. These 31 companies were analyzed individually by hand based on various financial, operational metrics, and 9 companies were selected for trend analysis. At this point, database scans become inaccurate and you need a seasoned, educated eye to peruse the footnotes of the filings and releases to catch the BSFP (BS in the fine print).

Step 7: Based on a trend analysis and the debt maturity schedules of these 9 companies, two companies – DIN US Equity and OTT US Equity were excluded owing to relatively stable earnings stream, no major debt maturities in the near-term and the debt largely carrying fixed rates of interest

Step 8: We have analyzed 6 companies out of the final shortlisted 8 comps and following are the key findings of these companies. Two comps are airline companies and their earnings stream is largely influenced by oil prices. Since the dynamics of this highly leveraged sector is different from most normal manufacturing businesses, we are looking deeper into these companies to come up with some empirical conclusions (this study has been completed and will be released as a follow-up analysis).

This is a snapshot of the initial 1,415 company initial scan along with solvency metrics for each company.

This is presented as a live, embedded spreadsheet and is available, free to all by clicking here (feel free to register as well, its free – register then choose the free subscription option). I urge all who may be bearish this summer to peruse the spreadsheet for it contains the pricing and major solvency metrics for over 1400 companies whose shares have skyrocketed over the past year. As some may realize, literally insolvent companies’ shares have participated in that skyrocketing!

The following link reveals the key details behind the weak points of the six shortlisted and analyzed companies (for subscribers only): Non-Financial Retail Subscriber Short List

Pro and institutional subscribers can access an expanded list of 33 companies here.

For those of you who have not registered or subscribed, there is still a company of interest that I will share in case you feel Europe will blow up and the US will hit a double dip recession. This is not nearly a strong a candidate as any of the subscription analyzed companies, but it is worth discussion.

5

Your rating: None Average: 5 (1 vote)[b] Unique way of getting through the trees in the forest. However, I am surprised he is willing to offer his research for free/low subscription cost. I guess in this day of age, e-sharing can help us all succeed. | |

|   | | Snapman

Posts : 625

Join date : 2009-06-25

Age : 36

Location : New York City

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  Fri Jun 25, 2010 4:44 pm Fri Jun 25, 2010 4:44 pm | |

| [quote="Batman"] - Snapman wrote:

- Interesting approach to stock picking:

Unique way of getting through the trees in the forest. However, I am surprised he is willing to offer his research for free/low subscription cost. I guess in this day of age, e-sharing can help us all succeed. Well to be honest, I think quite a few people do something similar but on different metrics or styles or preferences. I mean fundamentals are fundamentals after all | |

|   | | Sponsored content

|  Subject: Re: Equity Trading Subject: Re: Equity Trading  | |

| |

|   | | | | Equity Trading |  |

|

Similar topics |  |

|

| | Permissions in this forum: | You cannot reply to topics in this forum

| |

| |

| |